3D NEWS> ULTRA HD

Ahead of the release of a new report about 4K, specialist research and knowledge-based consulting firm Futuresource Consulting hosted two webinars yesterday called Going 4K: Looking Beyond the Hype.

The webinar, hosted by Adam Cox, Senior Market Analyst – Broadcast, Carl Hibbert, Head of Broadcast, Content & Services and David Watkins, Research Consultant, explored the reality of 4K and the commercial and technological factors that could

drive the technology forward.

Many broadcast professionals and vendors are looking towards 4K as being the next revolution in picture quality. 4K, also known as UHDTV (2160p) has a resolution of 3840 × 2160 (8.3 megapixels); four times the detail of HD but far short of the 8K standard NHK are planning to launch between 2016 – 2020.

Futuresource Consulting 4K Webinar Summary

In the market today, 4K production, equipment and viewing opportunities are few and far between. 4K is being led by the theatrical industry but outside of the limited number of 4K projector equipped theatres, there are few monitors, camcorders and displays capable of processing the format.

JVC launched the world’s first handheld 4K camcorder at the beginning of the year for just £4000 and Sony will soon release two 4K camcorders. Sony also recently announced their ultra HD TV will be pre-loaded with Hollywood native 4K content. Sony’s ultra HD TV will join similar mammoth sized sets from LG, Samsung, Panasonic, Toshiba and Hisense.

LG 4K 84 inch TV will be on display at The Gadget Show Live 2012

The experts were quick to remind the listeners that many countries, especially in Eastern Europe, are still in the process of upgrading to HD, and that the reality, away from the excitement of IBC, is that there is a long way to go.

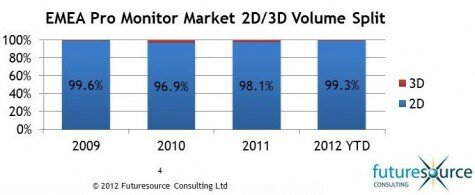

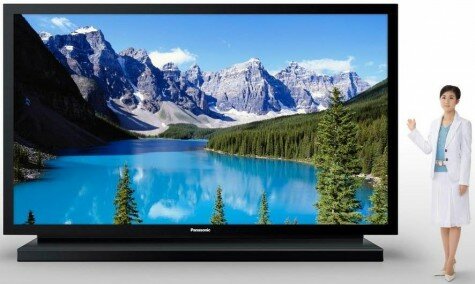

Natural comparisons were made to 3D and that, although 3D has not gone away, the format has not achieved the expectations predicted in 2009 and 2010 when nearly every trade show exhibitor was either talking about or showing off a new stereoscopic tool. Indeed, one slide (pictured) showed 2D pro monitors increasing in share, compared to 3D, after a slight fall in 2010.

When talking about where 4K is at now, attention was guided towards cinema where 4K is being pioneered, and a special credit was given to RED who ‘revolutionised the market’ back in 2007. RED cameras could shoot in 4K and now the ultra HD standard is well established in Hollywood. However, this is more of a ‘future-proofing process’ and despite more movies being filmed in the format, only around 50 4K films have been screened in theatres so far. Hollywood’s intentions are to create a back catalogue for when 4K displays and 4K Blu-ray players are in the home. Like 3D, this has already spawned a conversion market, with films like Lawrence of Arabia being re-scanned in 4K.

When questioning the rationale to go to 4K it was stated that it is a natural progression with an undeniable improvement in picture quality, a fact debatable with 3D. It was highlighted that during every 4K presentation at a trade show, crowds flock around the panels, despite only viewing static, slow based images – it is an easy sell. There is also no barrier to consumers – people do not need to wear a pair of glasses to enjoy the experience.

From a commercial perspective, the vendors simply need it, in a time when technology becomes increasingly commoditised. 3D went from being a premium product to a feature built in by default with little price premium when take-up was so lacking. TV manufacturers will need to deliver desirable technology that encourages people to upgrade, but in today’s economic climate, that is going to be a tough call. Throughout history there has always been a new technology feature to sell new sets – colour, NICAM digital Stereo, Widescreen, HD, tapeless, flatscreens, LED, OLED and 3D. It is one of the arguments that is used when debating whether, like in JAPAN, the industry should wait and skip straight to 8K (also known as Super Hi-Vision) – the cycle of upgrades is essential for TV manufacturers.

However, this could present its own problems, with upgrade fatigue seeping in, for both the consumer and the broadcast sectors. For broadcasters, they have noticed that consumer technology is being increasingly used for professional production. Rather than presenting a programme ‘best in class’; decisions are now determined by consumer acceptance and price and since the economic downturn of 2008/2009, there has been a feeling that ‘good enough’ is okay.

There are still technical concerns with 4K technology. There is a lack of industry standard interfaces to cope with the fast transfer of the increased data. Also, acquisition is currently based around large sensors. When sensors are reduced to a quarter inch, less light can reach the individual pixels so sensitivity will need to be increased. Gain can be added but that also causes noise which has implications for encoding.

Motion blur is also more apparent with 4K sequences so the frame rate may need to be doubled. However, that also halves the light and increasing the frame rate will add further bandwidth demands.

Compression for 4K will be achieved using the HEVC codec (High Efficiency Video Coding), due to be ratified in January, which offers up to 50% greater efficiency than H.264. At the IBC 2012 trade show, a HEVC encoder encoded video with a resolution of 3840×2160p at 60 fps with an average bit rate of just 15 Mbit/s.

NEVER MISS A 4K STORY. SIGN UP TO THE FREE WEEKLY E-LETTER ON THE RIGHT SIDE BAR

Broadcasters and Pay TV operators are already trialling the technology due to the need to continue innovation and maintain competitiveness. TV Globo in Brazil are very proactive in evaluating 4K thanks to the 2016 Olympics and Futuresource Consulting quoted DirecTV, Sky, Comcast, Canal + and SES Astra as all looking at the technology. In fact, a few operators are expected to launch 4K channels in 2014.

Blu-ray is also expected to benefit although consumers woud need to purchase new Blu-ray players capable of the decoding. There would be an ability to attach a premium price point to 4K Blu-ray discs although there could be some confusion for the consumer between 4K and 3D, as well as competition from online/OTT who themselves could benefit with higher tier pricing although there is a need for further improvement in broadband speeds.

4K could potentially be what 3D needs. In fact, the few consumer 4K displays available now are all 3D capable. It is a key enabler for glasses free 3D TV as well as full HD (per eye) passive 3D. However, with many saying 4K and especially 8K offers a more natural, realistic view of the world than 3D, it could be a difficult sell with such high resolution panels in the stores. NHK believe 8K is the minimum that 3D needs and that 3D will only be successful when it no longer requires glasses. Their 8K glasses free integral 3D system will even allow viewers to look around objects.

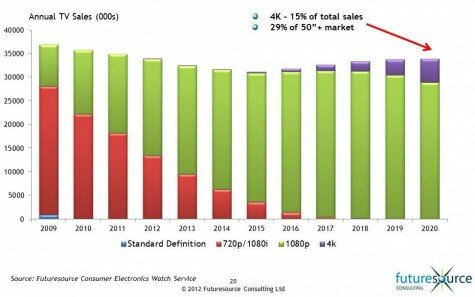

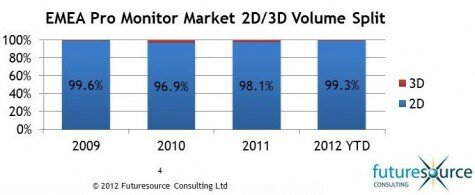

Looking to the future, Futuresource Consulting predict 4K will represent 15% of total TV sales in the USA by 2020. There is no doubt, a whole new set of opportunities could be opened up for 4K. BSkyB proved that millions of people were willing to pay an extra £10 per month for HD channels and once consumers see more and more 4K, especially during in-store demos, it could command the price premium that 3D has struggled to do so.

Futuresource Consulting are releasing a 4K report in December called The Strategic Impact of 4K. The report covers 4K in Digital Cinema, 4K Distribution and Standards, 4K Consumer Electronics Issues and Forecasts and 4K in the B2B Market. For more information visit www.futuresource-consulting.com.

FREE WEEKLY 3D NEWS BULLETIN –